First of all, before you can qualify for any loans or grants from the government you MUST have your parents fill out FAFSA!

Make sure this happens or everything else gets put on hold. You cannot even qualify for the T.I.P. if you do not fill out FAFSA! Once you’re accepted at a college you will be sent a financial aid package. This will be  individually tailored to your financial need. It will include grants (like the PELL) from the State and Federal government. It will also include proposed Loans – which you may or may not choose to sign for. It can also include things like Work-Study, which is a program that provides you an on-campus job as part of your package. Some of the loans that you will be offered will be subsidized and some unsubsidized. If you’ve been accepted at multiple schools, you will receive a separate aid package from each of the individual schools. Once you get your package call the financial aid office at the college with specific questions. Also bring into school to Mr. Wood or Kelsey or the Counseling Center for clarification.

individually tailored to your financial need. It will include grants (like the PELL) from the State and Federal government. It will also include proposed Loans – which you may or may not choose to sign for. It can also include things like Work-Study, which is a program that provides you an on-campus job as part of your package. Some of the loans that you will be offered will be subsidized and some unsubsidized. If you’ve been accepted at multiple schools, you will receive a separate aid package from each of the individual schools. Once you get your package call the financial aid office at the college with specific questions. Also bring into school to Mr. Wood or Kelsey or the Counseling Center for clarification.

Special Note here – this package from the university will NOT include separate scholarships that you may have won (such as Muskegon Community Foundation or Building a Better World). You will want to contact financial aid at the University to see how these scholarships alter your final package.

Lets take a look below at some of the basics below:

Go here for a Financial Aid calculator to estimate your college loan monthly payback schedule.

PELL GRANT – The Pell Grant is the Federal Government’s largest needs based grant awarded to college students. The most that you can get from a Pell Grant is $5500 per year. It is normally allocated in two equal portions between Fall and Winter semester. If your family income was less than $32,000 in 2012 you qualify for a full Pell Grant. The grant does not need to be repaid. Your parents must fill out the FAFSA for your to qualify for a Pell Grant.

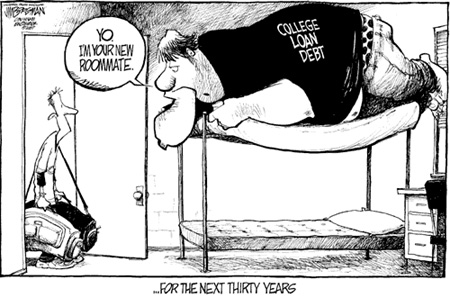

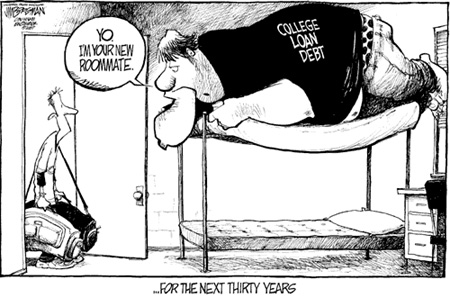

Subsidized & Unsubsidized Federal Loans – If a loan is subsidized that means that interest is subsidized by the Federal government while you remain at least a half time student. You are responsible for the loan repayment, however with a subsidized loan you accrue NO interest on the loan until six month to nine months after you graduate college. In order to delay repayment you must be attending school at least half time. A subsidized loan is the best option you can have. If you take out a unsubsidized Federal loan interest accrues immediately, however you still do not pay back the loan as long as you are attending school at least half time. The interest rate is normally higher on a unsubsidized loan since these are not based on need. Private bank loans – non Federal loans – are a dangerous way to pay for school. These loans are not backed by the Federal government. You attain them through the private banking industry and you begin paying principle and interest immediately upon securing the loan. The difference between the two is huge. Stay away from unsubsidized private bank loans if at all possible.

PDF Chart on Federally based Loans.

Check out this “easy to read” Brochure from Fifth Third Bank. It provides an accurate summary of the entire college borrowing experience. The fact that it is written by a private bank and stresses private bank loans LAST is significant, and should serve to remind that you go Federal First.

Perkins Loan is a great loan – The Perkins Loan is a subsidized, low interest (5%), needs based loan, good for up to $5,000 per year. Perkins Loans are eligible for Federal Loan Cancellation for teachers in designated low-income schools or shortage subject areas like math or science, or bilingual education. In either case you can have a certain percentage of your loan forgiven for each year that you teach. You may also qualify for reduction of a Perkins loan for service in the Peace Corps. It is the best loan that you can get.

Subsidized Stafford Loans are good loans – The Stafford Loan (also referred to as a Federal Direct Student Loan) may be subsidized or non-subsidized. Make sure that you know which one your school has offered to you as part of your financial aid package. The subsidized Stafford Loan is obviously better than unsubsidized version, since interest does not accrue while you are in school and in the end it costs less, the unsubsidized version is far superior to a private bank loan (learn more details here). In July of 2012 the interest rate for subsidized Stafford Loans will rise from 3.4% to 6.8%. The interest rate for an unsubsidized Stafford Loan will remain at 6.8%. This increase of Stafford Loan interest rates is another example of your Federal government devaluing education and public goods. Educate yourself to how politics dictates these things.

Direct Plus Loans for parents – The Direct Plus Loan for “parents only” is a signature loan that is often offered by Universities as part of a financial aid package. While the 7.9% interest rate is not as good as the Stafford or Perkins, a signature loan does not require collateral. Parents do not need to put up property to get the loan, they merely need to have adequate credit. Repayment however, begins at the time the loan is dispersed. This means that your parents begin paying it while you are attending school. This is not such a great option, however (because of the signature aspect) it too is better than going to a bank where you must have adequate collateral (house, property, etc) to qualify.

Again the key on loans – is subsidized or unsubsidized – Federal or Private. The Pell Grant is great! College based grants and loans offered from the University often require that you maintain a specific GPA to renew. To make sure that you know the specifics for each of your loans and grants in your financial aid package, call the Financial Aid department and have them walk you through your financial aid package.

Don’t forget the Federal Work Study Program. The Work Study Program provides funds for part-time employment to help needy students to finance the costs of postsecondary education. Students can receive FWS funds at approximately 3,400 participating postsecondary institutions. Hourly wages must not be less than the federal minimum wage. Work Study jobs are very very user friendly in working around your class schedule. A lot of the jobs are campus related. Dorm desk jobs, library, cafeteria, office work in a specific department – you can usually find available jobs online or at your university’s financial aid center.

Make sure if at all possible to stay away from private bank loans in financing your education. And don’t ever put it on a credit card!

Make sure if at all possible to stay away from private bank loans in financing your education. And don’t ever put it on a credit card!