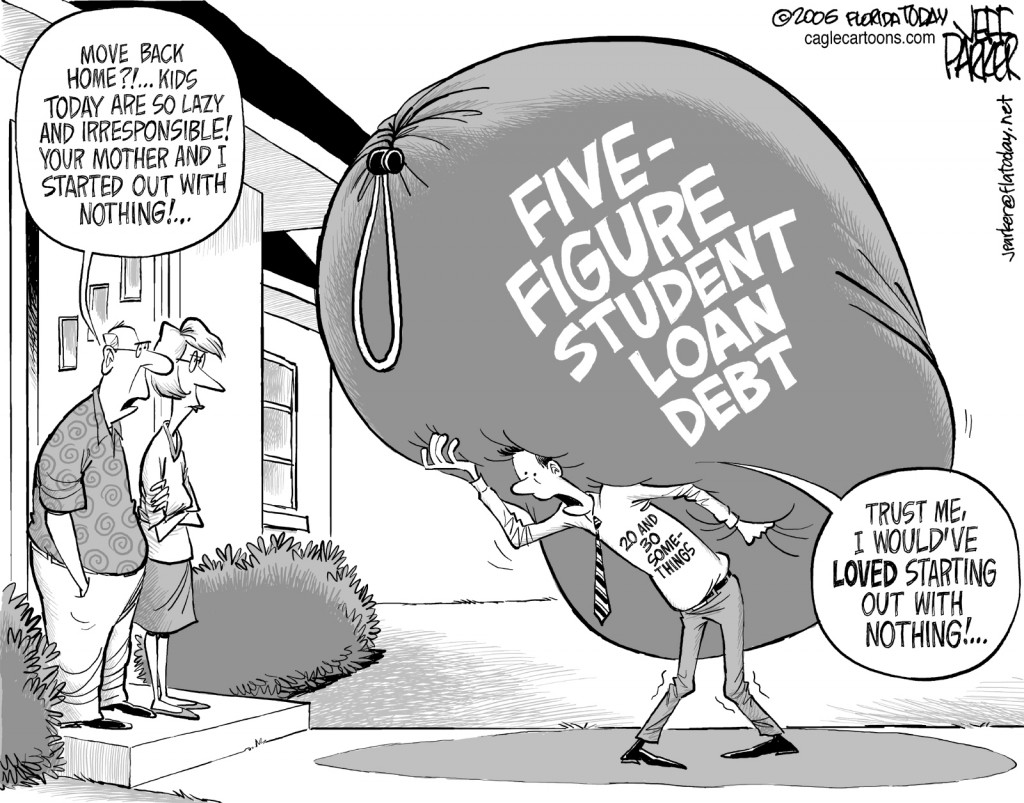

Don’t think that you must finish college in four 17 credit a semester no repeat, no mistake crammed years. Stuff happens…you know? On this blog from Scholarships.com Kayla Herrera from Michigan Tech talks about adjusting on the run and finishing in five. Read it…maybe you won’t be so stressed out.

Don’t think that you must finish college in four 17 credit a semester no repeat, no mistake crammed years. Stuff happens…you know? On this blog from Scholarships.com Kayla Herrera from Michigan Tech talks about adjusting on the run and finishing in five. Read it…maybe you won’t be so stressed out.

You can find the full article on scholarships.com.

Everything is blooming and trees are awakening with widening leaves stretching up toward the sky. The birds are chirpingand don’t forget the sound of graduation gowns sweeping across the floor! I should be graduating this year but like so many other college students my age, I have been thrown more than a few curveballs in my time in school and I have another year to go before I can enter into the workforce full-time. I want to assure you that this is okay and completely normal!

Here at Michigan Tech, we have a five-year plan. In order to graduate from Michigan Tech in four years, one must take 18 credits every semester, not includingsummer semesters. Not a fan of killing yourself with books, papers, exams, labs and a part-time job and would prefer to enjoy your time in college? That mentality is adopted by most students atMichigan Tech, making those who graduate in four years or fewer the minority.

Let’s face it – things happen: You change your major and have some serious catching up to do in prerequisite classes, you have a death in the family, youbecome seriously ill and take a semester off, or you just want to study abroad for a while. And that’s all more than fine, people! Yes, money is a huge issue (you can combat this by finding as many scholarships and grants as possible!) but at least we didn’t develop serious illnesses because of stress in an overworkededucational environment!

My advice? Take it easy and give yourself time to soak in all of the newinformation you are learning. Remember, don’t let anyone make you feel inferior for needing to stay in school for an extra year or two. There are colleges out there, just like mine, where the majority of students are on five-year plans – you just have to find them.

In addition to being a Scholarships.com virtual intern, Michigan Tech student Kayla Herrera is a media coordinator for the Michigan Tech Youth Programs and is a writer for The Daily News in Iron Mountain, Mich., Examiner.com and WHOA Magazine. She love a tantalizing, action-packed video game and can’t get enough of horror movies (Stephen King’s books always have her in their grip, though she prefers the old over the new). Writing is what she has always done, and that is what she is here to do.